June and July were strong months for the housing market. According to a report by Bank of America Securities’ US Economists Stephen Juneau and Michelle Meyer, sales of existing and new homes increased significantly in June and data points to stable demand for housing. This is further supported by the Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rising 16.6% to 116.1 in June. “It is quite surprising and remarkable that, in the midst of a global pandemic, contract activity for home purchases is higher compared to one year ago,” said Lawrence Yun, the chief economist for the National Association of Realtors. In June, home prices nationwide, inclusive of distressed sales, increased 4.9% year over year. In July, the national average median home price reached a new high, largely due to pent up demand and low inventory. The CoreLogic HPI Forecast indicates that home prices will increase on a month-over-month basis by 0.1% from June 2020 to July 2020.

While the recent data and sentiment are inspiring, the market is not necessarily out of the woods yet. That same report from Bank of America Securities that shined positive light on the housing market over the recent months suggests, “further improvement may be difficult to come by as some of the sharp recovery likely partly reflects a pull forward in activity and pent-up demand.” The report goes on to suggest how the economy and the housing market to a certain degree may be caught in a loop where lockdowns and restrictions lead to better progress with the virus that results in increased economic activity, which in turn leads to more infections and then renewed restrictions and a weakening in economic activity. This plays well into the argument recently put out by Neal Kashkari, president of the Federal Reserve Bank of Minneapolis. Kashkari suggests that an intense lockdown for a month to six weeks, followed by a national testing and tracing strategy, is the best way to go. Kashkari sees this as something that may be painful in the short term but will prove to provide more economic benefits in the long term than the current strategy of state and local governments dealing with the virus in a patchwork fashion. The issue of renewal and extension of federal aid is also a concern, implying a significant amount of risk to rental markets especially. The end of the $600 per week benefits and the inability of Congress to find a quick solution presents sizeable headwinds. Missed rent payments in the first two weeks of July were already up to 12.4% vs. 9.9% during the same time in 2019, according to online real estate database Zillow.

Despite the obvious potential headwinds, recent developments and other factors help support optimism surrounding the market. On August 8th, the president circumvented Congress and signed an executive order to provide jobless and student loan aid, suspend some payroll taxes, and impose a partial mortarium on evictions. While the effects of the executive order on the market will most certainly be complex, the jobless aid is most likely a substantial benefit to the rental market. Also, low-interest rates are a condition of this pandemic, and any further deterioration in the economy due to the pandemic will be accompanied by these low, and maybe even lower rates. These low-interest rates are a constant driver for buyers in the housing market. According to CoreLogic, “the recent rebound of home sales suggests the pandemic did not derail home buyers, who continue to be motivated by historically low mortgage rates. This, coupled with the declining supply of homes for sale, could shield home price growth from the impacts of the current economic uncertainty.” Michael T. Fay, principal, managing director and global head of Avison Young’s asset resolution team, summarized the situation when she said, “You cannot rely on putting money in banks or bonds in this low-interest-rate environment. You’re going to look at real estate and maybe some REITs.”

Corona del Mar Market Trends

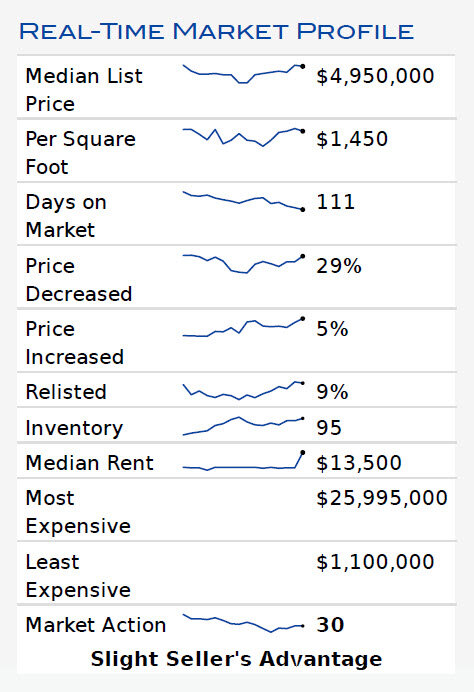

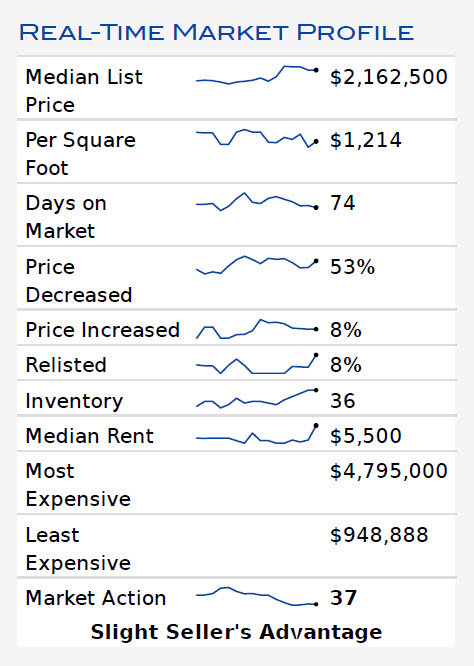

For both condos and single-family homes in Corona del Mar, inventory has been on the rise recently. However, there has been a decrease in average days on market as well. This suggests that buyer demand is rising to meet the new inventory levels. The reduction in average days on the market to counteract the increase in inventory has been more intense for single-family homes as opposed to condos/townhouses. This may partially be contributing to the market for condos and townhouses significantly cooling in recent weeks. However, a few weeks of decreased demand is really what would need to occur to see any significant price decreases and a buyer’s market. For single-family homes, recent developments are different from those of the townhouses and condos. The past couple of weeks have seen home sales exceed new inventory. If this trend continues, there may start to be some upward pressure on home prices.

Corona del Mar Market Trends (Single-Family Detached Homes)

Corona del Mar Market Trends (Condos)

Regardless of whether you are considering buying or selling, let’s connect today. We are here to help you navigate the market successfully during these unprecedented times. Our insight and experience allow us to provide you with the inside scoop on houses and the market that you won’t see online.

Phone: 949-464-7639