COVID-19 and Work from Home

One result of the pandemic has been a shift to remote work/work from home. While Covid-19 and its long-term effects in the United States are still uncertain, an increased emphasis on work from home seems to be one of the pandemic’s most apparent potential lasting effects. While the degree of that emphasis is still somewhat influenced mainly by future developments with the virus and vaccines, many companies and people have already made decisions for the future that involve an increased amount of remote work. For example, JPMorgan recently announced workers would cycle between working at the office and working from home, and it believes this new workplace regime will be permanent. Many other firms have already declared their employees will be working from home until at least the holidays or well into 2021. Even if the virus is contained and/or a safe vaccine is found, many businesses have learned to work remotely in an efficient way with traditional in-office activities performed at the same level of quality regardless of where the employee is working, signals that a significant number of work environments may shift toward a permanent work-from-home state (which also has the added benefit of reduced employer overhead) for the foreseeable future.

In this blog post, we examine what these means for the future of Orange County real estate.

Work from Home and What it Means for Orange County Real Estate

One potential result from an increased focus on work from home would be an influx of people moving to Orange County (OC) from Los Angeles (LA). The key reasons supporting this idea are less of a need to be close to LA offices, better home price value in OC markets vs. LA, a better quality of life in terms of traffic and time spent in the car for simple things such as shopping or dining out, and much less expensive higher quality schooling available for children in OC. These reasons and the belief that there are many comparable markets in OC and LA suggests that the future may be bright for OC real estate owners and investors due to LA residents moving to OC.

School Costs

Without the need to live in LA for work, many families may decide that the difference in education costs and free quality educational opportunities are too significant to pass up moving to OC. Due to the well-documented general low quality and lack of opportunities associated with LA public schools, many Angelenos see private schools as the only option for educating their kids in LA. According to Private School Review, the average annual tuition in 2020 for the top 255 private schools in LA was $11,527 for elementary schools and $22,525 for high schools. Contrast that with OC, where public schools do not suffer from the same lack of quality as LA public schools, and OC often has some of the highest-rated K-12 schools in the state of California or even the entire United States. Therefore, families could get high-quality education in OC for their kids at a much lower cost than they do in LA ($0.00 vs. $22,525 per child, per year). Without the need to work in LA offices, this presents a strong economic incentive for families to move from LA to OC.

Better Home Price Value and Home Buying Opportunity in OC Markets

Looking at comparable real estate markets between OC and LA in terms of community, relative market status, and environment, there is a lot to suggest value and opportunity in OC relative to LA. One comparable pair of markets, Manhattan Beach in LA and Newport Beach in OC, clearly demonstrates this when considering the single-family home real estate market.

Manhattan Beach and Newport Beach

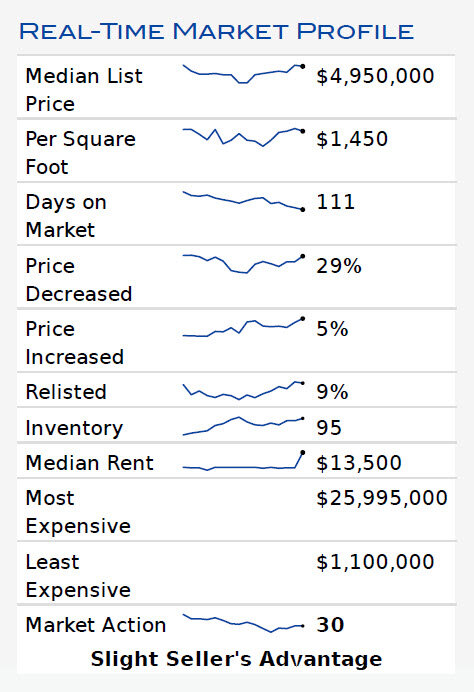

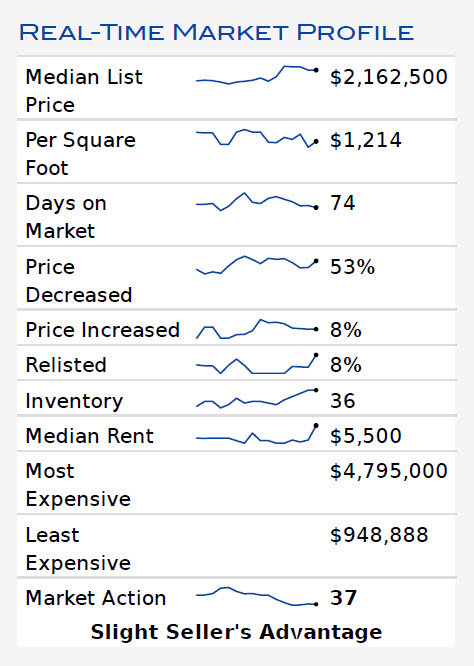

For example, from a value perspective, Newport Beach seems like a great play over Manhattan Beach. Currently, Manhattan Beach holds a significantly higher median sales price than Newport Beach. While this can be seen many times in history on the chart, it is also noticeable that the two lines always converge again after Manhattan Beach prices are higher than those in Newport Beach. Sometimes, Newport Beach even begins to have higher prices over Manhattan Beach after these corrections. If history teaches us anything, it is that this price gap won’t last forever, and any additional tailwind to the Newport Beach market due to the COVID environment may be enough to elevate its prices above Manhattan Beach in the future. In conclusion, it’s a better time to buy in Newport Beach (OC) than it is in Manhattan Beach (LA).

Furthermore, the inventory month supply chart also suggests an opportunity. In the past five years, Newport Beach has always had a higher months’ supply than Manhattan Beach. Very recently, that gap has decreased, and now Manhattan Beach has a higher months’ supply. Months’ supply is calculated by dividing active listings by the number of sales in the last six months divided by 6. A decreasing months’ supply suggests houses that are coming onto the market are being absorbed faster by buyers, and the opposite is true for increasing months’ supply. Newport Beach has a very similar and slightly lower months’ supply compared to Manhattan Beach for the first time in 5 years may be an early sign of changes in demands in these markets due to COVID-19 and shows Newport Beach as a value-play based on pricing and recent market trends.

Arguably the most important metric when considering value, the price per square foot, also supports a value argument for Newport Beach over Manhattan Beach. The price per square foot allows you to compare where you can get more bang for your buck when considering home size and space. As of August 2020, the median price per square foot of single-family real estate on a rolling 12-month basis was $876/Sqft for Newport Beach and $1,007/Sqft for Manhattan Beach. As shown in the table below, this is a common theme across comparable markets in LA and OC.

The comparable markets examined were:

Newport Beach (OC) vs. Manhattan Beach (LA)

Laguna Beach (OC) vs. Malibu (LA)

Huntington Beach (OC) vs. Santa Monica (LA)

Irvine (OC) vs. Sherman Oaks (LA)

Laguna Niguel (OC) vs. Encino (LA)

Newport Coast (OC) vs. Beverly Hills (LA)

This demonstrates that size and space cost more in LA relative to comparable OC markets. One’s money gets them further in terms of house size and space in OC relative to LA. With the COVID environment demanding work from home and the need for space within the home, OC markets offer a cheaper and arguably more comfortable solution to those new demands than do comparative LA housing submarkets. That coupled with the significantly lower cost to educate children in OC versus LA, and the higher quality of life in OC in terms of less time spent in your car commuting from point A to point B for simple things such as groceries, and you have a strong case for moving to Orange County from Los Angeles.

Despite the market turmoil and uncertainty, Titan Pacific Group is here to ensure you make the best decisions you can. Whether you are considering a real estate investment or in the process of selling and/or buying a home, we are here to help.

Sources: